Till Debt Tear Us Apart- Financial Healing Insights with Dr Wendy Labat

Do you feel trapped in a cycle of financial challenges? From struggling with anorexic income, overweight expenses, obese debt, or a spending addiction, the consequences can be overwhelming and crash your ability to achieve financial stability and prosperity.

When was the last time you dipped into your credit cards and savings accounts ? According to the Bank of England, this month there was a staggering £4.6 billion more withdrawn from bank and building society accounts than deposited. This marked the highest level of withdrawals recorded in the past 26 years, since comparable records began.

The relentless surge in the cost of living, starting with essential expenses such as grocery bills, mortgage payments, and rent, continues to put immense pressure on household finances. As families grapple with these mounting expenses, their financial well-being becomes increasingly strained, forcing them to dip into their savings and credit cards just to meet their daily needs.

The record-breaking withdrawal figures underscore the urgency for sustainable solutions to alleviate the burden of rising living costs and safeguard the financial stability of households across the nation.

The weight of debt can strain relationships to their breaking point. With divorce rates on the rise and the profound impact of financial stress on well-being, it is crucial to discover a path towards financial healing. In this insightful exploration, we explore compelling statistics surrounding the escalating cost of living, the heart-wrenching divorce rates, and the transformative power of overcoming debt.

Join us as we navigate the depths of financial turmoil, offering practical insights and strategies to rekindle harmony in both your finances and relationships.

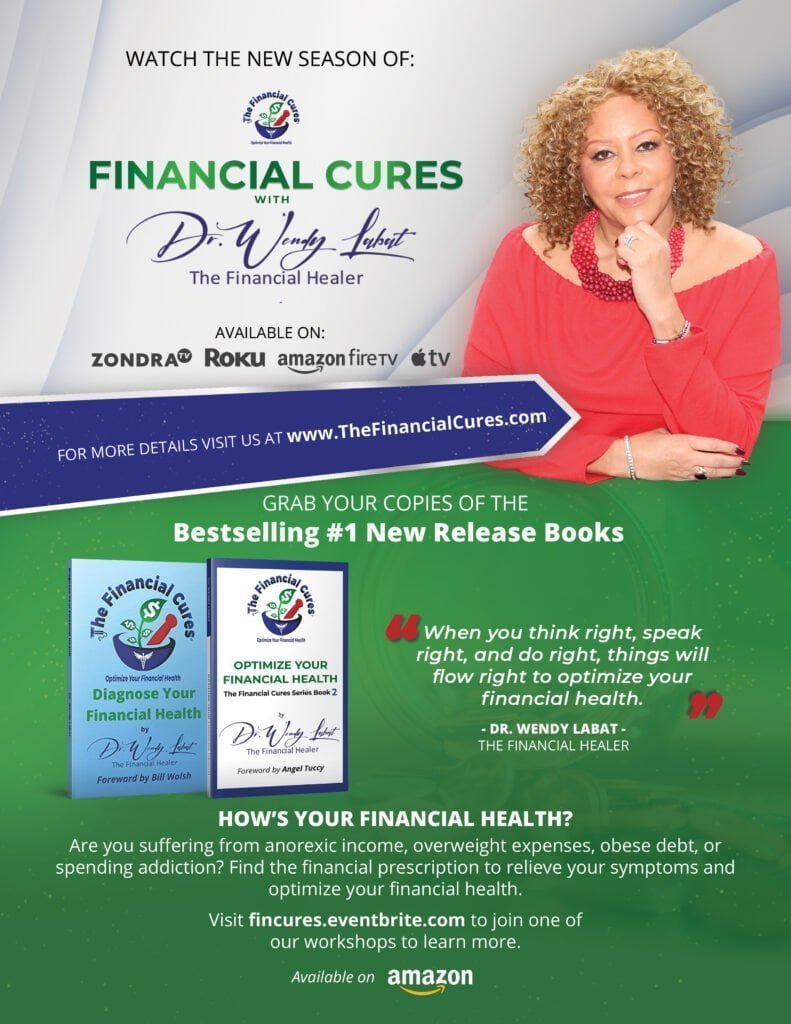

Do any of these financial conditions resonate with you: anorexic income, overweight expenses, obese debt, or a spending addiction? Keep reading! Dr Labat, known as the Financial Healer, is here to diagnose your financial health and prescribe the financial cure that will optimise your financial well-being. Millions love watching her show on TV.

Financial Healing: is it possible to heal before debt tears us apart?

The impact of the soaring cost of living extends beyond individual financial struggles and permeates into our relationships, putting additional strain on our personal connections and overall well-being.

Financial stress can act as a silent disruptor, slowly eroding the harmony and stability within relationships. As couples navigate the challenges of managing their finances amidst rising expenses, tensions often arise, leading to increased conflict and communication breakdown. Disagreements over budgeting, spending habits, and financial priorities can escalate, creating a significant source of friction between partners.

The strain caused by financial pressures can seep into other aspects of a relationship, affecting emotional intimacy, trust, and overall satisfaction. The constant worry about making ends meet, unexpected expenses, or the inability to pursue shared goals can take a toll on even the strongest of relationships.

In many cases, the financial burden becomes a recurring topic of contention, leading to resentment, blame, and a sense of helplessness. Arguments about money can quickly escalate into larger issues, exacerbating existing conflicts and potentially pushing couples to the brink of separation or divorce.

The impact is not limited to romantic relationships alone. Financial stress can strain relationships with family members, friends, and even colleagues. The burden of financial obligations can lead to increased social isolation, as individuals may withdraw from social activities or feel embarrassed about their financial situation. This isolation further compounds the negative impact on mental and emotional well-being, contributing to a vicious cycle of stress and strain.

Recognizing the detrimental effects of financial stress on relationships is crucial. It is essential for couples and families to prioritise open and honest communication about their financial challenges, fears, and aspirations. By approaching financial matters as a team and working together to find solutions, couples can foster a sense of unity and support in navigating the financial hurdles they face.

Seeking professional help, such as financial counselling or therapy, can also provide valuable guidance and tools to manage financial stress and improve communication within relationships. These resources can equip couples with strategies for effective financial planning, budgeting, debt management, and long-term financial goals.

Ultimately, addressing the impact of the high cost of living on relationships requires a collective effort. As a society, we need to advocate for policies that promote affordability, income equality, and access to resources that alleviate financial burdens. By creating an environment that supports financial well-being, we can contribute to healthier and more resilient relationships, fostering stronger social connections and overall happiness.

It is important to remember that while financial stress can strain relationships, it is not insurmountable. With open communication, empathy, and a shared commitment to finding solutions, couples and families can navigate the challenges of the cost of living together, fostering resilience, and strengthening the bonds that hold them together.

Behind the staggering divorce rates lies a sobering truth: financial problems are often the catalyst for relationship breakdowns. Statistics reveal a strong correlation between financial stress and the disintegration of marriages, second only to the anguish of infidelity. The weight of debt amplifies financial burdens, erodes trust, and undermines communication within relationships, threatening to sever the strongest bonds.

The impact of debt on well-being

Research consistently underscores the link between financial difficulties and marital discord. Studies reveal that financial disagreements rank among the top reasons for relationship dissatisfaction and eventual divorce. When families find themselves trapped in a cycle of mounting debt, the stress and tension surrounding financial obligations can quickly permeate all aspects of their lives. What begins as a strain on the pocketbook swiftly evolves into a strain on the emotional well-being and stability of the family unit.

Debt is not simply a financial burden—it affects every aspect of our lives, taking a toll on our mental and emotional well-being. The unrelenting pressure to meet mounting financial obligations engulfs individuals in a suffocating cloud of anxiety and sleepless nights. Studies conducted by the American Psychological Association underscore the profound link between financial stress and its detrimental effects on mental health. Beyond the confines of the mind, physical ailments compound the already challenging financial situation. Nevertheless, there is hope for sailing away from debt and building financial well-being.

Dr. Wendy Labat is a remarkable individual who has transformed the lives of countless entrepreneurs, business owners, families, and individuals across the United States. Her journey, fraught with challenges, began over 36 years ago when she embarked on the path of entrepreneurship with no prior business experience and limited financial resources. Through perseverance, self-discipline, and a relentless passion to heal, Dr. Labat overcame these obstacles herself, building a successful business empire from the ground up.

Her journey into wealth didn’t stop there. Driven by her own personal experiences and a deep desire to heal the world of the poverty pandemic, she developed The Financial Cures SystemTM. which combines the knowledge and experience to help individuals diagnose and optimise their financial health.

The destructive cycle of debt and divorce

Debt, particularly when left unaddressed, can unravel the fabric of a marriage. The weight of financial burden can ignite heated arguments, erode open communication, and breed resentment between partners. As the pressure mounts, couples may find themselves caught in a destructive cycle: debt-induced stress contributes to relationship strain, which, in turn, hinders effective financial decision-making and impedes debt repayment efforts. The growing chasm between partners can become insurmountable, leading to an increased likelihood of separation and divorce.

When you think right, speak right, and do right,

things will flow right to optimize your financial health.

Dr Wendy Labat

Impact on Children and Extended Family

The repercussions of financial debt extend beyond the immediate couple. Children are often caught in the crossfire of strained relationships and the subsequent divorce process. The emotional toll of witnessing their parents’ financial struggles and marital discord can have long-lasting effects on children’s well-being and future relationships. Additionally, extended family members may find themselves entangled in the fallout, as they witness the disintegration of once-close bonds due to financial stress.

While the statistics on growing divorce rates are disheartening, there is hope for couples seeking to preserve their relationships and navigate the challenges posed by family financial debt. By proactively addressing your financial situation and adopting healthy financial practices, you can begin the journey towards financial healing as a couple.

Open and honest communication is a vital component of this process. Establishing shared financial goals, creating a realistic budget, and actively involving both partners in financial decision-making fosters a sense of unity and collaboration. Seeking professional financial guidance can also provide valuable insights and strategies for debt management, budgeting, and long-term financial planning.

Couples must prioritise emotional support and empathy as they navigate the challenges of debt and work towards a common goal. By approaching their financial journey as a team, couples can reinforce their bond and strengthen their commitment to weathering the storm together.

The growing divorce rates attributed to family financial debt highlight the urgent need for couples to address their financial challenges head-on. By recognizing the impact of debt on relationships, couples can take proactive steps towards financial healing, nurturing open communication, and seeking professional guidance when needed. With dedication and a shared commitment to overcoming financial obstacles, couples can preserve their relationships, build a solid foundation for their future, and navigate the complexities of family financial debt with resilience and strength.

Dr. Labat’s transformative work is even more awe-inspiring when considering the additional hurdle she faced in her battle with breast cancer. Her unwavering spirit and resilience allowed her to conquer a chain of challenges along the way and develop her own financial well-being solution.

Dr Wendy Labat’s approach goes beyond surface-level remedies; she dives deep into the root causes of financial challenges, providing practical strategies and step-by-step guidance to overcome them. Her methods have helped individuals from all walks of life gain control over their finances, enabling them to build a solid foundation for a prosperous future.

Through her remarkable journey and the development of The Financial Cures SystemTM, Dr Wendy Labat has emerged as a beacon of hope for those seeking financial healing and transformation. Her passion for empowering individuals to achieve financial freedom shines through in every aspect of her work. With her guidance, you can break free from the shackles of financial stress, embrace financial empowerment, and embark on a journey towards a brighter and more prosperous future.

Financial healing is a proactive and practical approaches to personal finance, to help you regain control over your financial well-being, mend fractured relationships, and forge ahead with dignity and confidence.

Anorexic income: overcoming financial starvation

Do you feel trapped in a cycle of financial challenges? From struggling with anorexic income, overweight expenses, obese debt, or a spending addiction, the consequences can be overwhelming and crash your ability to achieve financial stability and prosperity.

Anorexic income refers to a situation where your earnings are insufficient to meet basic needs and achieve financial goals. It often leaves you feeling trapped in a cycle of scarcity, unable to break free and build a secure financial future. What are the strategies that can boost your income? Can you start exploring additional income streams, enhancing job skills, pursuing entrepreneurship, or investing wisely? By taking proactive steps to increase earnings, you can nourish your financial well-being and move toward financial abundance.

Overweight expenses: trimming the fat from your finances

Overweight expenses occur when spending surpasses your income, leading to a perpetual state of financial imbalance. Dr. Labat’s approach involves conducting a thorough assessment of spending habits and identifying areas where expenses can be trimmed without sacrificing quality of life. By implementing a realistic budget, prioritising needs over wants, and adopting mindful spending practices, individuals can shed the excess weight of unnecessary expenses, creating a leaner and healthier financial profile.

Obese debt: shedding the burden of financial overindulgence

Obese debt refers to an overwhelming burden of debt that hinders financial progress and causes immense stress. It can stem from high-interest loans, credit card debt, student loans, or mortgage payments that exceed one’s means. Dr. Labat’s offers effective debt management strategies, including debt consolidation, negotiation with creditors, and prioritising repayment. Through disciplined financial planning and commitment to debt reduction, individuals can shed the weight of excessive debt, regaining control of their financial well-being.

Spending addiction: breaking free from destructive patterns

A spending addiction can wreak havoc on one’s financial health, leading to a constant cycle of impulsive and excessive spending. Dr. Labat recognizes the psychological and emotional factors that contribute to this behaviour and provides tools to address and overcome the addiction. Through awareness, self-reflection, and seeking support, you can break free from destructive spending patterns and cultivate healthy financial habits that align with your long-term goals.

The Financial Cure: a path to financial well-being

If you find yourself grappling with any of these financial conditions, know that you are not alone, and there is a way forward. Through her own personal journey, Dr Labat has empowered numerous couples to overcome anorexic income, overweight expenses, obese debt, and spending addiction. Her holistic approach encompasses both practical strategies and a mindset shift necessary for lasting financial healing.

As we celebrate Financial Literacy Month, let’s commit to empowering ourselves and others with financial knowledge. Together, we can create a society where individuals have the tools, the understanding and compassionate support to navigate the complex world of finance, fostering economic growth, stability, and personal well-being.

About Dr Wendy Labat -The Financial Healer

Dr Wendy Labat, The Financial Healer, is the CEO of The Financial Cures LLC, an MWBE. The creator of The Financial Cures System®, aresults-basedprogram for financial mastery. Dr Labat is the best-selling author of The Financial Cures Book Series: Diagnose Your Financial Healthand Optimize Your Financial Health. She is the producer and host of the award-winning global streaming production of Financial Cures with Dr Wendy Labat, an award-winning entrepreneur, business strategist, and international speaker.

Dr Wendy empowers entrepreneurs, corporate executives, and individuals to ease the pain of inflation, overcome anorexic income, obese debt, spending addictions, mindset and knowledge deficiencies, and other financial ills to optimize their financial health, enjoy financial freedom and live the life they desire.

Dr. Wendy Labat has been awarded the Blue Rose Brilliance Award by ZondraTV Network for her global streaming show Financial Cures with Dr. Wendy Labat. She received the Black Authors Matter TV Award for Best Interview in Business/Careers/Education/Leadership/Non-Fiction. She also won the Media Mastery Spotlight Award from Vedette Global Media for being featured on over 100 stages, podcasts, books, and magazines. Dr. Labat has beenfeatured on the cover of TAP-IN Magazine as one of the Top 25 Influential Leaders of 2022, Authority Magazine, VoyageATL Magazine, Sovereign Magazine, Success Profiles Magazine, Black Enterprise, The Whole Woman Magazine, The Atlanta Tribune, PBS American Portrait, Daring Leaders, and Lemonade Legend Magazine to name a few. She was named “Top Entrepreneur/Business Owner” by Marquis Who’sWho, and “Living Legend” by the Walden University Student Alumni.

Dr Labat is the Founder and CEO of Ascend Foundation, Inc., a 501(c)3 organization established to empower disadvantaged women to realize their dreams of entrepreneurship. She serves as Treasurer on the Board of Directors of the Zion Hill Community Development Corporation, a 501(c)3 foundation established to provide resources for disadvantaged families. Dr Wendy Labat has her Doctor of Administration (DBA) in Entrepreneurship and almost four decades of experience as an entrepreneur.

Connect and Learn More

Follow Dr. Wendy Labat on Facebook, Instagram or LinkedIn

Discover the Financial Cures Show by Dr Wendy Labat

Apply to be a guest on Dr Wendy Labat show

Do you want to share your story and inspire our readers ? Know that every story is paving the way for a brighter, happier future.