More Important than Money: Women’s Financial Literacy

More and more women are asking themselves: What can be more important than money? Women are achieving unprecedented success in various spheres of life, from entrepreneurship and leadership to academia and the arts. Yet, beneath this impressive exterior, there lies an alarming disparity – the gender financial gap.

Shockingly, a study conducted by the National Endowment for Financial Education has revealed that only 18% of women feel confident about their financial knowledge, compared to 35% of men. This glaring discrepancy indicates a pressing need to address the issue of financial literacy among women.

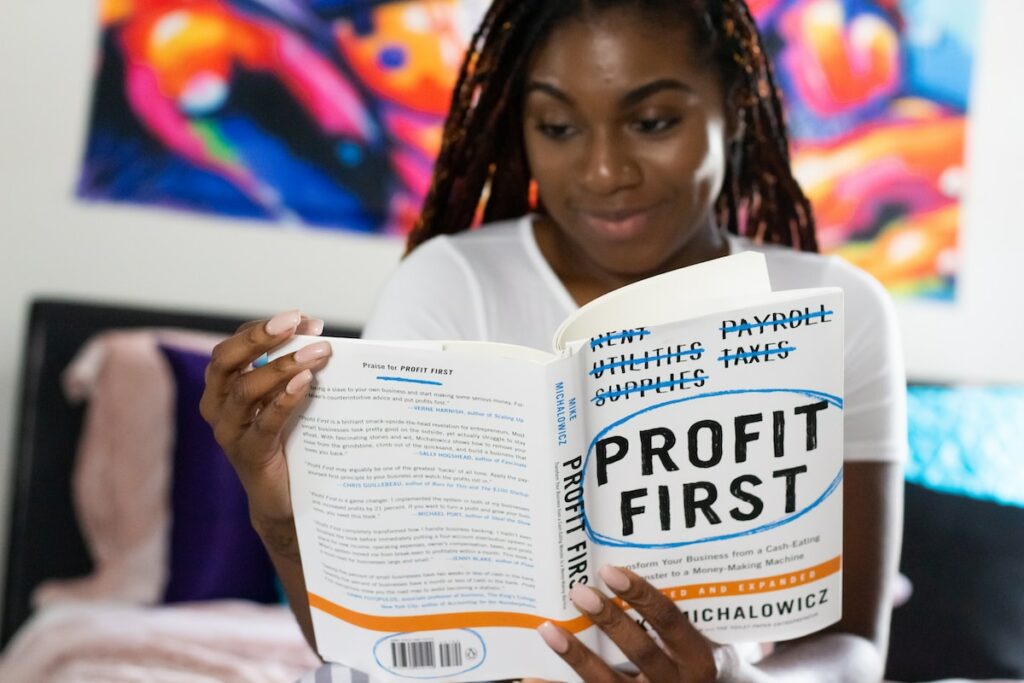

Financial literacy is not just about understanding money; it’s about self- empowerment, independence, and the key to unlocking a world of opportunities. It’s about giving women the tools they need to navigate the complexities of personal finance, investments, and retirement planning. In this article, we will look into the critical importance of financial education for women, supported by compelling statistics, and explore how it can be a catalyst for greater independence, confidence, and life satisfaction. Let’s embark on this transformative journey toward financial empowerment for women.

The Gender Financial Gap

Understanding and addressing the gender financial gap, we can move closer to a world where women have equal access to financial opportunities, greater independence, and increased life satisfaction. One of the most significant impacts of financial literacy is its potential to break traditional gender stereotypes. By encouraging women to take charge of their finances, we challenge societal norms that suggest they should be financially dependent. Instead, we promote the idea that women can be self-sufficient, successful, and leaders in their financial lives.

Women, despite their remarkable progress in various fields, still face unique financial challenges. However, the path to financial independence starts with knowledge, and that’s where financial literacy plays a pivotal role.

Financial literacy is the cornerstone of financial independence. It enables women to take control of their financial destiny and make informed decisions. Whether it’s managing investments, planning for retirement, or starting a business, a solid financial education equips women with the skills needed to navigate the complexities of the financial world. It empowers them to set goals and work toward achieving them without being dependent on anyone else.

A lack of financial knowledge can lead to uncertainty and self-doubt when making financial decisions. However, women who are financially literate gain confidence in their ability to manage money effectively. They are more likely to negotiate better deals, ask for raises, and invest wisely. This newfound confidence extends beyond financial matters and can positively impact various aspects of life, including relationships and career advancement.

Studies have shown that financial literacy is linked to higher levels of life satisfaction. When women are in control of their finances and are making informed choices, they report a greater sense of well-being and overall happiness. Financial stability leads to reduced stress, improved mental health, and a greater sense of accomplishment. It allows women to pursue their passions and dreams without the constant worry about money.

Financial Education: A Lifelong Journey

Financial literacy is not a one-time endeavour; it’s a lifelong journey. To empower women through financial education, we need to promote ongoing learning and provide resources tailored to their needs. This includes workshops, online courses, and mentorship programs that address specific financial challenges women may face, such as the gender pay gap, career breaks for caregiving, and unique investment considerations.

Empowerment through financial literacy is not just a concept; it’s a tangible reality. Women who take the initiative to educate themselves about money matters find themselves on a path to greater independence, confidence, and life satisfaction. As a financial editor for women, my mission is to provide the tools, resources, and knowledge needed to bridge the gender financial gap. Together, we can empower women to take control of their financial destinies, break free from stereotypes, and lead fulfilling, financially secure lives. Financial literacy is not just about dollars and cents; it’s about achieving your dreams and realizing your full potential.

What is more important to you: money or financial literacy? The verdict is in your hands, and with it, the power to make a difference. Let us choose a future where women’s financial literacy is not just a choice but a fundamental right, a future where financial literacy is more important than money itself.

Do you want to share your story and inspire our readers ? Know that every story is paving the way for a brighter, happier future.